Business leaders warn that three-decade era of globalisation is ending

The 3-ten years period of globalisation pitfalls heading into reverse in accordance to business executives and traders, as environment leaders put together to satisfy in the Swiss city of Davos for the initially time since the coronavirus pandemic began.

The geopolitical fallout from Russia’s war in Ukraine, merged with the disruption to global provide chains prompted by the virus, recent marketplace turmoil and the quickly worsening financial outlook depart company leaders and buyers grappling with critical strategic decisions, various told the Money Instances in interviews.

“Tension involving the US and China was accelerated by the pandemic and now this invasion of Ukraine by Russia — all these developments are boosting severe concerns about a decoupling world,” claimed José Manuel Barroso, chair of Goldman Sachs Worldwide and a former president of the European Commission.

Onshoring, renationalisation and regionalisation had turn out to be the most recent traits for companies, slowing the pace of globalisation, he added: “[Globalisation faces] friction from nationalism, protectionism, nativism, chauvinism if you want, or even from time to time xenophobia, and for me, it is not clear who is going to win.”

“Pretty a great deal no one particular has seen” these circumstances “during the arc of their investing career”, in accordance to the head of one particular of the world’s biggest non-public equity teams. Charles ‘Chip’ Kaye, chief executive of Warburg Pincus, reported geopolitics experienced been “on the fringe of the way we thought” given that the drop of the Berlin Wall and that this had “provided a sure oxygen to worldwide growth”.

Nevertheless, he stated, geopolitics was now “front and centre” of investment decisions just as the “pretty effective tailwind to asset prices” delivered by years of falling inflation and small curiosity rates will come to an end.

“You’re not optimising the economic consequence, you’re producing friction in the method,” he reported of mounting geopolitical tensions.

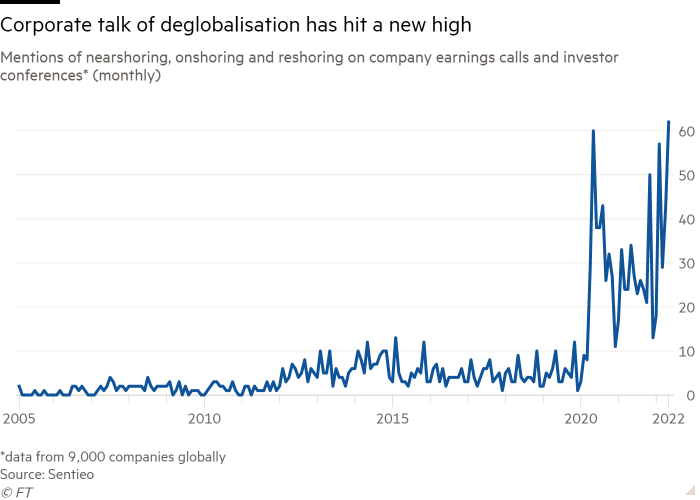

Communicate about deglobalisation amongst businesses has mounted in latest months. Mentions of nearshoring, onshoring and reshoring on company earning phone calls and investor conferences are at their highest stage considering that at minimum 2005, in accordance to data company Sentieo.

The matter will be higher on the agenda for attendees at the Entire world Economic Forum in Davos this week. Considering the fact that its very last assembly in January 2020 planet occasions have scrambled the source chains that underpin the globalisation that the WEF champions.

“Companies are indicating I have to have my production nearer to my prospects,” explained Jonathan Grey, president of Blackstone Group.

The head of Asia’s premier pharmaceutical organization stated the period of globalisation based mostly on outsourcing functions to slash fees was around.

Christophe Weber, main executive of Takeda, which is headquartered in Tokyo, Japan, claimed drugmakers would proceed to seek out advancement in global markets, specially China simply because of its high likely. But corporate concentration had shifted to a more sustainable type of globalisation, he mentioned: “It’s a question of de-jeopardizing your supply chain.”

“It would be a short-slice to say that globalisation is around but the globalisation that individuals have in intellect is not genuine any a lot more,” Weber stated. “The globalisation which existed a number of several years back, trade without the need of constraints, and the ‘world is flat’ strategy, is finished.”

Takeda has carried out a twin sourcing policy to establish extra redundancy into its source chains, Weber extra: “I never believed [outsourcing] would work prolonged-term but I consider this is very clear for every person now.”

Buyer industries are also encountering a shift absent from globalisation, in accordance to Rachid Mohamed Rachid, chair of Valentino and Balmain.

Some luxury businesses are rethinking their technique, which tended to depend intensely on global branding, selling to tourists and transport products all around the entire world, he explained: “The small business has long gone local . . . Stores right now in London or Paris or Milan are now catering for their nearby inhabitants additional than they made use of to just before.”

In the earlier two decades businesses have begun to “look neighborhood and begin performing regionally as a substitute of acting globally”, he explained to the FT’s Organization of Luxurious convention before this week. “In various marketplaces like the US, Europe, Asia, even lesser marketplaces like Latin The usa and Africa, persons are seeking domestically now and I’m positive there’ll be a ton of local promotions using location.”

Dominik Asam, chief economic officer at Airbus, warned this could have significant economic consequences.

“If a significant portion of decades of productivity gains pushed by globalisation was reversed in a quick interval of time, this would generate inflation up and result in a important, protracted economic downturn,” he mentioned. “This is just why I think that big economic powers will arrive to the summary that they have to do everything they can to avert such a devastating situation.”

Barroso blamed a much less co-operative spirit at a political degree inside the G20 now when in contrast with the monetary disaster in 2008. Political leaders must distinguish amongst serious geopolitical variations and the necessity to deal with issues such as public well being and climate alter, he claimed.

Germany’s central financial institution chief Joachim Nagel outlined deglobalisation as one particular of the “three Ds” that would “add to inflationary pressures” alongside decarbonisation and demographics.

The change absent from globalisation was remaining “fuelled by geopolitical tensions and the need to reduce financial dependencies”, the Bundesbank president stated just after a conference of G7 finance ministers and central bank governors in Königswinter, Germany, previously this week.

Additional reporting by Brooke Masters and Sylvia Pfeifer in London and Martin Arnold in Frankfurt