City eyes zoning changes to keep payday loan companies away from vulnerable groups

Again in 2019, Shelly-Ann Allan’s lender refused to lend her the cash she needed to aid spend for her father’s funeral, so she experienced to turn to a payday personal loan firm.

But what she failed to account for was the demise of her stepfather soon immediately after. She experienced to take out another payday financial loan on best of the one that continue to experienced a equilibrium of $1,500.

“The desire costs [have] crafted up and constructed up on me, and there is exactly where it really is influencing me appropriate now,” said Allan, who life in close proximity to Jane and Finch, an region of the metropolis that has a disproportionately substantial variety of payday financial loan firms.

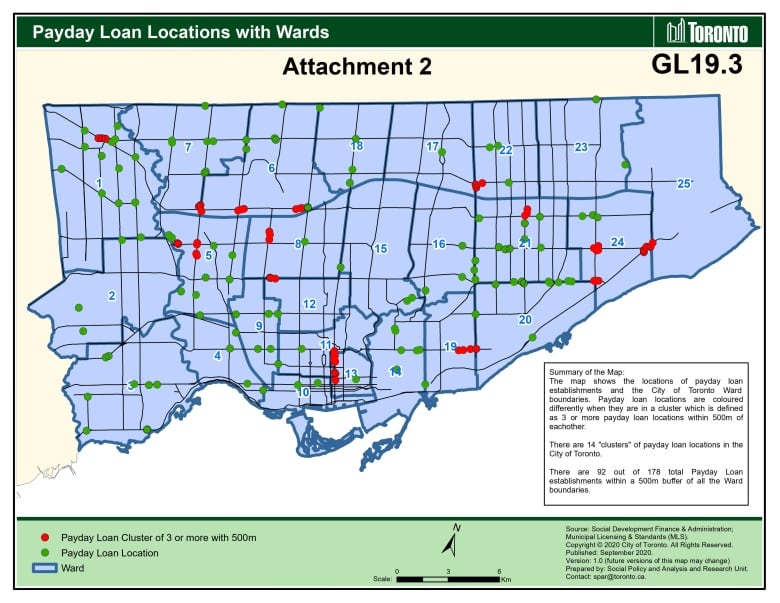

Critics say the concentration of these firms in low-revenue communities allows perpetuate the cycle of poverty. Which is why Toronto city council is discussing a recommendation this 7 days from its Housing and Planning Committee that would bar new payday loan outlets from setting shop within 500 metres of social services workplaces, social housing, liquor stores, casinos and pawnshops.

In accordance to Allan’s agreement with the payday mortgage business easyfinancial, her cumulative desire amount now stands at 47 for each cent, and she now owes $24,000. She suggests the place she lives, people today will need more than just zoning constraints to prohibit payday lenders, they also need financial establishments that will lend them cash at fair fascination premiums.

“People like myself … the financial institution would not look at me to lend, since they claimed that I would not be ready to spend back again that income,” reported Allan.

Zoning limitations

At this time, lenders in Ontario can charge no extra than $15 in curiosity for just about every $100 borrowed.

Irrespective of that, University of Toronto finance professor Andreas Park claims annual share premiums can hit more than 400 per cent for limited-phrase payday loans, and additional desire can be used if the bank loan isn’t paid by the term’s conclusion, in accordance to the Payday Loans Act.

A 2021 report by city staff says zoning restrictions would only implement to new institutions, and could not retroactively implement to current kinds.

In 2018, the town capped the amount of payday personal loan licenses and locations. The town says this has contributed to a much more than 20 for every cent reduce in such establishments, from 212 to 165 as of Jan. 26. But a new supplementary report produced times forward of this week’s city council meeting reveals there has been restricted movement by the remaining payday shops, with only three moves since the metropolis brought in those constraints.

Staff recommended locating “enhancements to shopper security and obtain to low-price tag money services” as a way to control the marketplace.

Coun. Anthony Perruzza, who represents Ward 7, Humber River-Black Creek, claims that’s all part of the city’s Anti-Poverty Reduction Initiative.

“But that system is continue to in the operates, and it’s nonetheless some a long time in the making.”

Park says zoning limitations versus corporations are limited in their ability to deal with the heart of the trouble.

“It is instead striking that these payday lenders are so widespread in lousy neighbourhoods, and that there is no greater service currently being offered,” mentioned Park, who agrees vulnerable groups need better accessibility to loans with fair curiosity costs.

“Why do we not have methods in position that help them overcome some of the worries that they confront?”

ACORN Toronto, an advocacy organization for very low and center-profits groups, says while it welcomes the reduction in payday loan outlets, the metropolis ought to follow Ottawa and Hamilton, which have previously implemented zoning constraints.

“The far more commonly citizens see these companies, the far more probable they are to look at accessing the substantial compounding curiosity loans,” wrote Donna Borden, the head of East York ACORN, in a letter to the town.

“We feel this is not about scheduling rationale, it really is about fairness, human legal rights, and good banking.”

City requirements federal, provincial aid

The very last time council discussed the topic was December 2020, in which it produced quite a few requests to the federal governing administration to improve enforcement towards predatory lending and to the province to provide cheaper financial loan alternatives for consumers.

The Ontario federal government has instructed CBC News it is reviewing opinions from a 2021 consultation with stakeholders and the public on techniques to tackle the trouble..

Moreover, the federal Ministry of Finance reported in an electronic mail assertion that the governing administration is wanting at cracking down on predatory creditors by decreasing the criminal rate of fascination, which is now set at 60 for each cent. Nevertheless, payday lenders are exempt from this provision in provinces that have their personal economical regulation method, such as Ontario.

Perruzza claims these creditors are predatory and want to be regulated from all amounts of authorities, specially in the wake of COVID-19.

“We actually will need to impress on the federal and provincial governments that this is a big challenge, and they want to use their legislative tools at their disposal.”