Personal traders who entrust their revenue to cash espousing environmental, social and governance concepts may — unwittingly — be serving to finance companies that “make local climate alter worse, not better”.

So operates the assert of US car enterprise Tesla, at minimum. The electrical car large not too long ago utilized its 144-web page yearly Effects Report to slam the ESG rating sector. Amongst Tesla’s problems had been significant scores for its “gas-guzzler” rivals and “unrealistic assumptions” about their carbon emissions.

Even though bitter grapes and aggressive rivalry may partly clarify this broadside, Tesla is considerably from becoming the to start with to convey annoyance about the methodologies employed by ESG analysts.

For case in point, in a damning review revealed past year, scientists at MIT’s Sloan College of Administration and London Business enterprise School highlighted huge discrepancies in ESG measurements, persistent details high quality troubles, and difficulties in evaluating organization scores in opposition to money performance.

Florian Berg, a research fellow at MIT and co-creator of the paper, concedes that the complexity and the breadth of problems that drop within just the remit of ESG defy easy evaluation — and says a diploma of variance is to be expected.

A lack of sturdy, publicly obtainable facts is also problematic, he notes. To make up for knowledge gaps, ESG firms normally convert to industry averages. But, when that could make the maths neat, the hazard is that poor performers get away with turning out to be “free riders”.

Outside of these specialized shortfalls, Berg also identifies an overarching flaw in today’s evolving ESG assessment market place: particularly, a deficiency of transparency close to how closing rankings are arrived at.

The methodologies used by ESG knowledge suppliers remain “very much a black box”, he says. “They might give you the name of the indicators they use and, potentially, the weights of these indicators, but I really do not know any that obviously explain how these indicators are established or what data go into them.”

Criticism of ESG scoring programs for failing to exhibit their workings obviously is common.

In light of this kind of fears, the European Securities and Marketplaces Authority is currently in the initial phases of a community session on the ESG indicators made use of by big ranking providers.

Laurent Babikian, joint global director of funds markets at CDP, an environmental disclosure organisation, is 1 of people who deride the “artistic way” in which ESG scores are presently calculated.

“There is crystal clear regulation in spot for credit rating score organizations but for ESG rating vendors or ESG data suppliers there is no regulation,” he claims.

Any these kinds of regulation would need to address a basic philosophical breach amongst ESG rankings that measure exclusively the money hazards of social and environmental challenges and those that evaluate the constructive or adverse impacts of a business’s activities far more broadly.

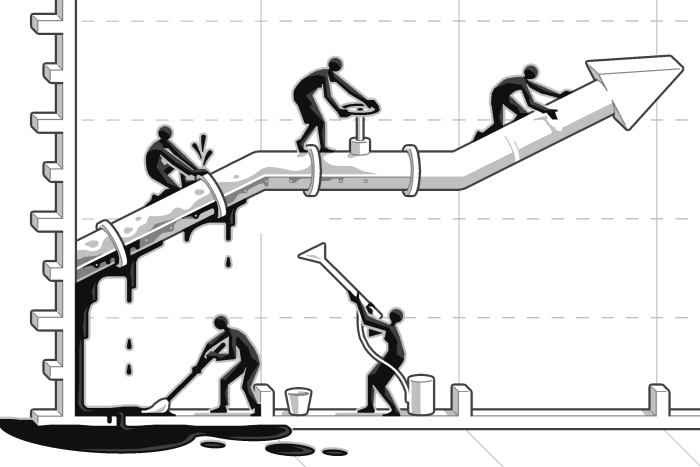

How should investors clean up up the world’s dirtiest firms?

Coming on May well 31: The Ethical Revenue Forum digs deeper into the arguments for divestment, engagement or new ways that mix aspects of equally methods

At present, regulators continue being divided on the route to get.

The US-based world-wide economical reporting human body IFRS seems to favour the previous “single materiality” place, although the European Fee leans toward the 2nd, wider, “double materiality” tactic.

For their element, ESG analysts are cautious about just one successful out in excess of the other. The idea of a one standardised solution to sustainable rankings would undermine the adaptability and nuance at this time created into the system, they argue.

Wherever critics see inconsistency and unexplained variance, massive ESG companies issue to personalized tips and perception for specific shopper interests.

“With ESG, there is a range of opinion in the marketplace — and that is good,” states Richard Mattison, president of intelligence provider S&P International Sustainable1.

“If you assume about typical money information and facts, like earnings estimates, for illustration, they do differ in their thoughts, and they vary in the techniques they use to come to all those thoughts,” he factors out.

This kind of a line of argument comes with the “major caveat” that the people of these types of views are very clear on the assumptions and choices that lie driving them — one thing Mattison insists that S&P Worldwide Sustainable1 reveals “with wonderful transparency”.

In a similar vein, financial investment study business MSCI is wary about a one standardised technique to ESG ratings, despite the fact that it says it welcomes the advancement of voluntary rules of perform for the industry.

This kind of principles should really make provision for “transparency and consistent application of rating methodologies”, suggests Neil Acres, MSCI’s world wide head of authorities and regulatory affairs.

As the regulation debates rumble on, developments in electronic technologies may offer you a partial reaction to the clamour for transparency in ESG marketplaces.

Escalating current market demand for facts about enterprise functionality and threats arising from climate and other non-financial issues has prompted a host of fintech companies to enter the market place in current several years.

Numerous act as info aggregators, hoovering up general public and private knowledge sets that they then supply to traders by quick-to-access, customisable electronic platforms.

No cost of any methodological filtering, these platforms supply a decrease-value signifies of mapping raw ESG knowledge versus the conditions of specific money and investment techniques, states Ángel Agudo, vice-president of item at Clarity AI, an ESG information organization.

The New York-based mostly get started-up makes use of equipment learning to categorise information on 30,000 companies and 135,000 money, in addition 375 countries and local governments.

Acquiring an over-all score that can aid an trader classify businesses is helpful up to a stage, says Agudo. But, he provides: “What ESG buyers definitely want is to recognize companies’ personal traits and then weigh these as they see match.”