For newcomers, it can look like a excellent plan (and an fascinating prospect) to purchase a organization that tells a fantastic story to traders, even if it absolutely lacks a monitor history of income and income. But as Warren Buffett has mused, ‘If you have been participating in poker for half an hour and you nevertheless really don’t know who the patsy is, you’re the patsy.’ When they get these story shares, traders are all way too typically the patsy.

In contrast to all that, I like to expend time on corporations like Xcel Electrical power (NASDAQ:XEL), which has not only revenues, but also earnings. Even if the shares are entirely valued currently, most capitalists would realize its gains as the demonstration of constant benefit era. Conversely, a reduction-making corporation is yet to establish alone with gain, and sooner or later the sweet milk of external capital may possibly operate sour.

Check out our latest analysis for Xcel Electrical power

Xcel Energy’s Earnings Per Share Are Growing.

As a person of my mentors after told me, share price tag follows earnings for each share (EPS). That means EPS progress is deemed a actual favourable by most profitable prolonged-phrase buyers. Xcel Electrical power managed to mature EPS by 5.9% per calendar year, around 3 decades. When that kind of development fee is just not incredible, it does exhibit the business is expanding.

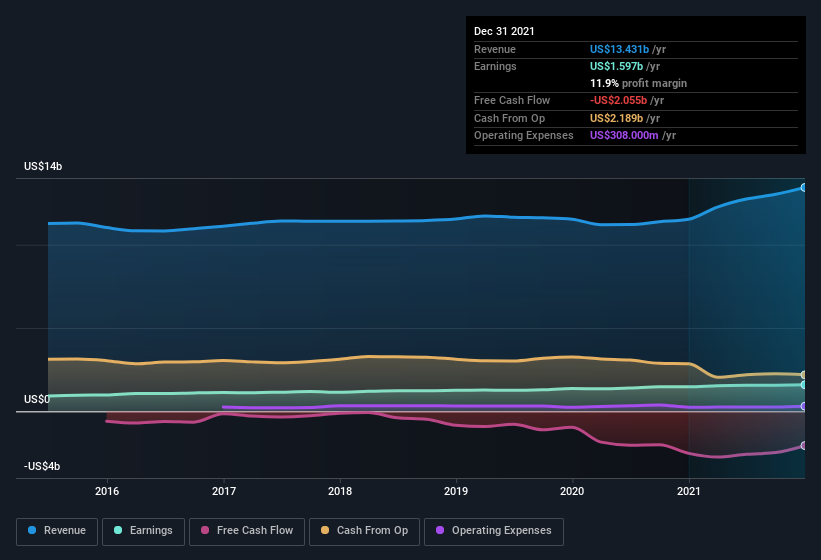

I like to see major-line expansion as an indicator that progress is sustainable, and I glimpse for a high earnings in advance of interest and taxation (EBIT) margin to stage to a aggressive moat (although some businesses with very low margins also have moats). On the a person hand, Xcel Energy’s EBIT margins fell about the previous year, but on the other hand, income grew. So if EBIT margins can stabilize, this top-line advancement really should fork out off for shareholders.

The chart beneath demonstrates how the firm’s base and top rated strains have progressed about time. For finer element, simply click on the image.

Fortuitously, we have obtained access to analyst forecasts of Xcel Energy’s foreseeable future revenue. You can do your very own forecasts with out looking, or you can just take a peek at what the specialists are predicting.

Are Xcel Power Insiders Aligned With All Shareholders?

Considering the fact that Xcel Strength has a industry capitalization of US$41b, we wouldn’t count on insiders to maintain a substantial share of shares. But we do get ease and comfort from the reality that they are investors in the firm. To be precise, they have US$47m value of shares. Which is a ton of dollars, and no tiny incentive to operate tricky. Even however that is only about .1% of the corporation, it truly is ample money to reveal alignment involving the leaders of the small business and standard shareholders.

It usually means a whole lot to see insiders invested in the enterprise, but I locate myself pondering if remuneration guidelines are shareholder welcoming. A quick investigation of the CEO payment implies they are. For organizations with current market capitalizations about US$8.0b, like Xcel Energy, the median CEO pay is all over US$12m.

The Xcel Electrical power CEO received complete payment of just US$4.1m in the calendar year to . Which is clearly properly under normal, so at a glance, that arrangement appears to be generous to shareholders, and factors to a modest remuneration lifestyle. CEO remuneration ranges are not the most crucial metric for buyers, but when the spend is modest, that does aid increased alignment in between the CEO and the regular shareholders. I might also argue fair shell out levels attest to excellent selection making additional typically.

Should You Incorporate Xcel Strength To Your Watchlist?

1 favourable for Xcel Electrical power is that it is escalating EPS. That is good to see. The reality that EPS is developing is a real constructive for Xcel Energy, but the really photo gets better than that. With a meaningful stage of insider possession, and sensible CEO pay, a acceptable intellect could conclude that this is one particular inventory really worth viewing. We should really say that we have discovered 2 warning symptoms for Xcel Vitality (1 does not sit as well nicely with us!) that you really should be aware of just before investing listed here.

Of training course, you can do very well (occasionally) getting shares that are not expanding earnings and do not have insiders buying shares. But as a expansion investor I generally like to check out corporations that do have all those attributes. You can accessibility a no cost listing of them below.

Please notice the insider transactions reviewed in this article refer to reportable transactions in the related jurisdiction.

Have feed-back on this write-up? Concerned about the material? Get in contact with us specifically. Alternatively, electronic mail editorial-workforce (at) simplywallst.com.

This short article by Basically Wall St is common in mother nature. We present commentary primarily based on historic details and analyst forecasts only applying an impartial methodology and our posts are not intended to be financial tips. It does not represent a suggestion to obtain or promote any inventory, and does not acquire account of your targets, or your economical situation. We purpose to bring you long-time period concentrated assessment driven by essential data. Notice that our analysis may well not variable in the newest price tag-sensitive corporation bulletins or qualitative substance. Just Wall St has no posture in any stocks outlined.