Inflation Is Hiding in Your Receipts: All the Extra Fees to Watch Out For

This tale is section of So Revenue (subscribe in this article), an on the net local community committed to fiscal empowerment and guidance, led by CNET Editor at Large and So Cash podcast host Farnoosh Torabi.

What is actually taking place

As businesses confront inflation, some are passing down amplified fees to shoppers with new charges at checkout.

Why it issues

With inflation up 8.3% per year, the hottest round of merchant service fees are adding to consumers’ wallet woes.

What it usually means for you

Understanding about these fees can enable you control your budget and make far better getting choices.

Across the region, some organizations are tacking on new expenses — allegedly to offset the load of inflation and provide chain shortages. These elevated merchant charges for labor and overhead may be popping up on your future receipt, and you might not even see them until the bill arrives. The additional charges are introducing a layer of financial shock at a time when inflation is previously costing the ordinary house $311 far more dollars each individual thirty day period, according to economists at Moody’s Analytics.

“Most of the time we obtain out about these service fees when it can be time to fork out, not before,” Ashley Feinstein Gerstley, author of Financial Adulting, advised me through e-mail. “Simply because these costs seriously run the gamut, you never genuinely know what you are going to get.”

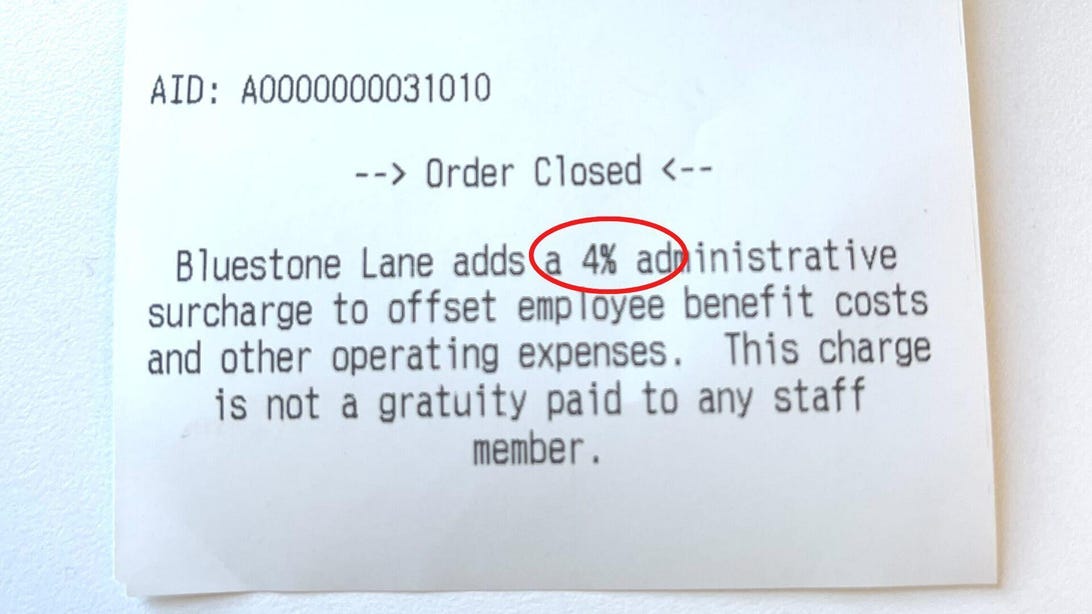

Glimpse out for surcharges like these on your restaurant payments.

Courtney Johnston/CNET

I questioned my Instagram followers about these new and surprising service fees, and they gave me hundreds of anecdotes. From eating places to medical places of work to rideshare services, here is a glimpse at some more recent (or just surprising) costs that I have uncovered. And I am going to provide ideas on how to manage these unexpected surcharges.

Restaurants are charging much more, and not just for foods

A lot of dining places are still reeling from a fiscal slump for the duration of the 1st calendar year of the COVID-19 pandemic. Now, with mounting meals and payroll fees, eateries continue on to wrestle. “Ordinary modest enterprise places to eat operate on very limited margins of all around 3 to 5% pre-tax,” explained Hudson Riehle, senior vice president of investigation with the National Restaurant Association. “The common restaurant enterprise design is not set up to deal with this sustained and accelerated cost of meals and labor, which is placing incredible force on operators, and indications are these will keep on.”

Listed here are some of the new costs you may perhaps see on your cafe monthly bill:

Credit history card surcharges

Before this spring, main credit history card corporations like Mastercard and Visa increased interchange expenses, which is what retailers fork out to card issuers each and every time a consumer makes use of a credit score card. Also acknowledged as “swipe costs,” they charge firms 1.5 to 3% per transaction. They’re most demanding for smaller sized institutions like places to eat, and some are passing this cost on to prospects as a percentage of their whole invoice.

When Feinstein Gerstley dined out with her household very last summer time in Sapphire, North Carolina, the cafe charged a credit rating card processing payment that she claims was not stated until eventually the invoice arrived: “We were a party of 15 who experienced beverages, applications, dinner and dessert so the demand was sizeable, around $100.” Several states allow organizations to pass on their card swipe service fees to buyers, but they need to correctly disclose the surcharges on visible signage and their web-sites. The consumer price also can not exceed what the business pays to the credit rating card firms.

Increased labor charges

Back again in April, Sarah Morisson noticed a $5 surcharge when the bill for her enchiladas arrived at a restaurant in Alpharetta, Ga. The rationale? “Increased labor costs.” This may possibly also be called a “kitchen area appreciation cost” in some eateries and arrives in the form of an additional $3 to $5.

Health and fitness care expenses

Places to eat are competing for employees and supplying additional positive aspects as a draw. This extra value may possibly clearly show up on your receipt upcoming time you eat out. In Chicago previous thirty day period, Rema Shamon observed a few dollars added to her eating monthly bill labeled “wellbeing treatment for workers.” Likewise in West Hollywood, California, Claudia Scott was charged 3% additional for “personnel health insurance coverage” at a neighborhood eatery.

Incorporate-ons for staff members who do not get tips

At a sandwich shop in Portland, Maine, a few months ago, Jennifer Steralacci and a mate paid a $4 fee “for non-tipped employees” — and that was on best of the gratuity. “I failed to recall viewing anything on the menu that indicated this charge,” Steralacci explained to me.

Rideshare and food delivery apps are charging a lot more for gasoline

Service fees ended up already climbing simply because of the pandemic, but as rideshare firms compete to employ motorists, they’re luring them with indicator-on bonuses and larger shell out. That is one more reason your rideshare whole seems more highly-priced than ever. On major of that, in March, Uber and Uber Eats announced a new gas price to support motorists include the expense of soaring electrical power prices.

That’ll cost an more $.45 or $.55 on just about every Uber journey and both $.35 or $.45 on each Uber Eats food stuff order, relying on the site. Uber states 100% of that charge goes to drivers. Rival rideshare enterprise Lyft has also introduced a 55-cent gas surcharge. Grocery delivery application Instacart claims it is tacking on a new 40-cent fuel rate, also.

Service fees at doctors’ workplaces are incorporating to the shock, as well

Improved provide and resources fees

Continue to keep an eye out for this line-product value at your up coming healthcare check out, which ranges in selling price. In Dallas, Texas, Kelsie Whittington received hit with an uncommon $18 “offer price” soon after her son’s schedule pediatrician check out in May perhaps. The health care place of work stated that it was for pricier bed handles, needles, gauze and other devices.

With coverage companies sluggish to issue reimbursements, the clinic was obtaining clients eat the cost. “I was a minor stunned at 1st, then empathetic. I required to pay for my son’s overall health,” Whittington stated.

Facility expenses

Though doctors’ places of work have been charging facility charges because just before the pandemic, sufferers may perhaps not know about them right until they get an itemized bill. According to Consumer Experiences, facility expenses, which generally go over the price tag of retaining the health care office, urgent care centre or clinic which is owned by a medical center, can incorporate hundreds of bucks to a monthly bill… and insurance policies may perhaps only partly cover it.

What can you do about all the additional concealed costs?

To lessen the blow of these new expenses and surcharges, we need to gather facts and be ready to self-advocate. In this article are four items of information:

1. Concern the charges: We might sense uncomfortable or ashamed to inquire about new and unconventional costs. But if a organization is not upfront and hasn’t disclosed their charges in advance of time, it’s in just our suitable to have an understanding of and question thoughts. We may perhaps master that the charge is justified and we’re in fact joyful to pay back it and go on patronizing. In other conditions, it may possibly prevent us from returning.

2. Question for a dollars price reduction: Like lots of gasoline stations, some dining establishments supply income discounts to aid lessen their credit rating card processing prices. For illustration, at The Fifth Season restaurant in Port Washington, New York, dollars-shelling out diners obtain a 3.5% bill reduction by means of its Income Discount Plan promoted on the eatery’s web-site.

Even if not marketed, ask if a business will give you a funds discount, a gain-win for each you and the merchant. I’ve efficiently employed this trick at compact, independently owned suppliers, way too.

3. Assume 2 times about using 3rd occasion shipping and delivery apps: Delivery apps are convenient but they can swiftly double the charge of your pizza get following charges, taxes and the advised 25% tip. Ordering consider-out the aged-fashioned way by contacting the cafe specifically could end result in considerable savings. Some eateries may possibly call for you to choose up the food stuff, but other people may offer absolutely free supply of their personal — just be positive to suggestion the driver. If you want to adhere with third get together deliverers, MealMe can help establish the cheapest options by comparing pricing across the board.

4. Vote with your ft: It’s our selection in which and how to commit, and if paying out excess charges is too significantly to bear, we have the ideal to stroll away and patronize a distinctive small business up coming time. When a restaurant supervisor refused to remove the shock credit score card surcharge, Feinstein Gerstley claimed a family member in attendance shared the encounter on Yelp. “We unquestionably didn’t return to the cafe,” she explained.

If a cost does not appear with any suitable disclosure, the service provider may perhaps be in violation of state guidelines, so client advocates recommend submitting a complaint with both of those your credit card issuer and the state legal professional typical. According to Riehle, “The restaurant marketplace is quite competitive, and operators know that if a consumer’s previous expertise won’t meet up with their anticipations, they are very likely to vote with their feet.”