“It’s a difficult working day,” study the e mail matter line to Shelly Tiny from her bosses at Carvana, an on the internet used car retailer.

The be aware signalled Very little was a single of practically 2,500 workers laid off from the US-based enterprise this 7 days, in a mood described by one more worker as “mass hysteria”. Because the start of the calendar year, stock in the company famed for its towering multistorey automobile “vending machines” has fallen 84 for every cent.

“As the ramifications of that kicks in all I can believe is — wow,” Minor wrote on LinkedIn, informing her close friends and coworkers that she was 1 of the 12 for every cent at Carvana being shown the doorway.

Her working experience demonstrates the sudden sobriety that has descended over the US technological innovation sector, prompted by a deep and broad stock market-off as buyers fret more than rising fascination premiums and slowing financial advancement.

Privately held corporations are currently being pressured to readjust expectations on valuations, obtain to funding and hunger for chance-getting between venture capitalists that might no for a longer period throw warning to the wind.

“I consider it’s definitely humbling for a great deal of people in know-how who imagined issues would under no circumstances go yet another way, or did not prepare for a rainy working day, or were being a little bombastic,” explained Semil Shah, a founder and general associate at San Francisco-based mostly venture cash agency Haystack.

“If you had been truly counting your chickens before they hatched, or you were considering about all the riches that would occur your way, it is going to take a whilst.”

In the general public marketplaces, Carvana has been a person of the worst hit, but it is by no means by itself. DoorDash, the US market chief for restaurant food items supply, is down 49 per cent year to date. Affirm, just one of the biggest in the formerly extremely-fancied acquire-now-pay out-afterwards sector, has crashed 75 for every cent. Shopify, the ecommerce operator routinely billed as the most really serious risk to Amazon’s ecommerce dominance, is down 67 for every cent. The photograph had been even bleaker until eventually an uptick throughout the board in the course of investing on Friday.

Even Big Tech firms, some of the surest growth stocks for the earlier decade, have suffered massive drops. Apple, Amazon, Alphabet and Meta have collectively witnessed $2.1tn wiped off their marketplace capitalisations. In Apple’s circumstance, its $600bn dip was adequate to see it dethroned this 7 days by Saudi Aramco as the world’s most valuable publicly traded corporation.

That an strength big should really take above its mantle is illustrative of the change in trader self-confidence from organizations with powerful major-line growth but shakier base strains to people that are surer bets, reported Brent Thill, an analyst with Jefferies.

“It’s a comprehensive-scale, total puke of tech, a whole-fledged eject button,” he reported. “Less than a year has gone by and all large-advancement application organizations are now evil with no revenue. I feel it is a wholesale change out of tech into defensive sectors, power and utilities.”

Tech providers are reacting by tackling the fundamental principles — chopping expenditures, cutting down hard cash melt away and concentrating on the fundamentals.

“I’ve been talking about totally free money movement additional than I imagine I have given that I took my very first accounting class, it’s sort of wild,” explained just one individual at a main public tech business.

Equally, at Uber, with its stock down 45 for each cent this year, chief executive Dara Khosrowshahi informed employees in a memo past weekend: “The goalposts have changed. Now it is about free of charge income stream.”

“In occasions of uncertainty, traders search for safety,” he extra in the take note, very first reported by CNBC and confirmed by the Money Moments. “They recognise that we are the scaled leader in our classes, but they never know how a lot which is value. Channelling Jerry Maguire, we require to exhibit them the dollars.”

After considerably renaming and reorienting his business very last calendar year, Meta main government Mark Zuckerberg’s eagerness around the metaverse has built way for a extra clipped enthusiasm for major financial investment. The social media organization past month pledged to decrease its investing forecasts by various billion dollars across this calendar year.

To obtain it, Meta has pulled the handbrake on aggressive headcount advancement. In accordance to an internal memo from Meta’s chief financial officer David Wehner, acquired by the FT, it recruited a lot more personnel in the to start with quarter of this calendar year than in the full of 2021 — but this has arrive to an stop.

“We will need to acquire a further glance at our priorities and make some tough decisions about what initiatives we go just after in both equally the limited and medium expression to achieve the decrease price assistance we committed to all through earnings,” he wrote, incorporating: “This will have an effect on practically just about every crew in the company.”

An additional Meta executive’s note said scheduled task interviews for what would have been potential junior and mid-amount engineering employees will be “sensitively cancelled”.

Twitter, possibly on the brink of takeover by Elon Musk, mentioned on Thursday it experienced not satisfied its own “intermediate milestones” for advancement, so it was “pulling again on non-labour costs to guarantee we are remaining dependable and efficient”.

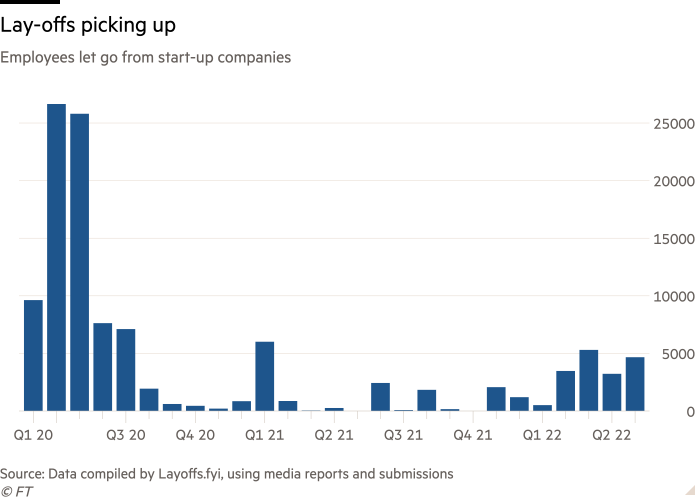

Providers across the tech sector are taking a close seem at headcount as an quick way to cut costs. Layoffs.fyi, a internet site that tracks lay-offs amid community and private tech start out-ups, has logged a surge commencing in February, nevertheless degrees are still way beneath the early levels of the coronavirus pandemic. Shipping “ghost” kitchen get started-up Reef, celebrity shout-out system Cameo and dieting and wellness application Noom are between the non-public companies shedding personnel.

How the tech sell-off begins to effect the non-public sector, and the funding ecosystem that underpins it, is only just commencing to be felt.

In accordance a report released by analytics group PitchBook this 7 days, providers closest to shifting to the general public markets and trying to get to elevate greater rounds have been the first to practical experience a headwind, going through a “much diverse sentiment from investors” in contrast to valuation highs in 2021.

According to CB Insights, world-wide undertaking funds funding in the 1st quarter of 2022 was down 19 per cent on the preceding quarter, the major proportion drop due to the fact the third quarter of 2012. The selection of community exits — regardless of whether by first community featuring or Spac merger — was down 45 for each cent.

Haystack’s Shah mentioned income for start off-ups has already become harder to come by for companies without the need of a firmly recognized company model.

“People are however creating cheques,” he stated. “But if you are elevating 500k, or 5mn or 50mn, you have to combat for it — a lot additional than you would have had to struggle for it a calendar year ago.”