Modern improvements in the UK’s best task have had a positive impact on pound sterling and prolonged-time period sovereign bond yields. But the financial market reaction has been muted in comparison with the monetary turmoil blamed on previous key minister Liz Truss and ex-chancellor Kwasi Kwarteng in modern weeks.

Immediately after the mini-budget on September 23, the marketplaces reacted to a lousy policy: Truss’s strategy to undertake large tax cuts with out offering significantly certainty on how this would be funded. Its reversal introduced bond yields down from recent highs (effectively cutting down the price tag of federal government borrowing) and noticed the pound enjoy. But in general, the sector losses observed following the mini-budget have scarcely been recovered.

To buyers, audio and stable financial guidelines make a difference a great deal a lot more than the man or woman residing in Selection 10. And which is why, even with a new prime minister, current market place actions reveal traders continue on to see more substantial difficulties with the United kingdom financial state, both equally straight away and more than the extended term.

In the limited time period, yields on Uk sovereign bonds have shot up right after the mini-spending plan, rising the government’s price of borrowing. The absence of an accompanying forecast by the Office of Budgetary Obligation (OBR) exacerbated this damaging response.

Prior to this, the Financial institution of England experienced been considering a bond-offering physical exercise to consider to carry rising inflation back to its 2% concentrate on by lowering the supply of money in circulation (this is known as quantitative tightening). As a substitute, it experienced to quickly transform program after the mini-price range. It not only postponed this tightening, but also restarted quantitative easing and bond purchases, promising to acquire up to £10 billion in gilts for each day to handle a linked disaster among the pension resources.

Two issues will now ascertain future sovereign bond generate dynamics and dictate government borrowing charges.

First, clarity on how long the Bank of England programs to continue on its coverage of quantitative easing (buying bonds to retain yields small) ahead of it reverts to quantitative tightening all over again. Markets are observing these steps really diligently and any suggestion that this aid by the Bank will be lower off could make traders and investors anxious.

Second, the government’s medium-expression fiscal prepare, at present scheduled for Oct 31, will also influence bond yields. Contrary to the mini-funds, this plan will arrive with an in-depth evaluation from the OBR, offering marketplaces much more details. Furthermore, the existing chancellor, Jeremy Hunt, has introduced some of the fiscal approach actions forward to simplicity market problems.

It is nevertheless unclear what kind of strategy it will be, on the other hand. A personal debt-slicing tactic from Hunt and the new govt headed by Rishi Sunak should guarantee the marketplaces about the UK’s fiscal balance, but it’s continue to mysterious regardless of whether this would happen by using more taxes or much less paying. Some proof on what would be greatest for the overall economy supports elevating capital revenue taxes (capital gains tax and inheritance tax) alternatively than slicing public paying out or increasing revenue taxes.

In the prolonged time period, the UK’s important problems are stagnating expansion and absence of productivity. And if the new governing administration addresses present issues by increasing taxes and slicing spending – along with increased interest rates from the Financial institution of England – there will be far more financial agony.

Transforming world financial state

Many nations around the world are suffering related issues to the United kingdom, contributing to a weak international economic outlook in common appropriate now. Soon after a extended period of historically ultra-lower curiosity costs, will increase – so-referred to as normalisation of monetary policy – had been expected in most nations around the world. But a sharp surge in inflation because of to Russia’s invasion of Ukraine and pandemic-period source chain issues have brought about most central banking institutions to scramble to tighten financial policy even further by growing prices additional fast.

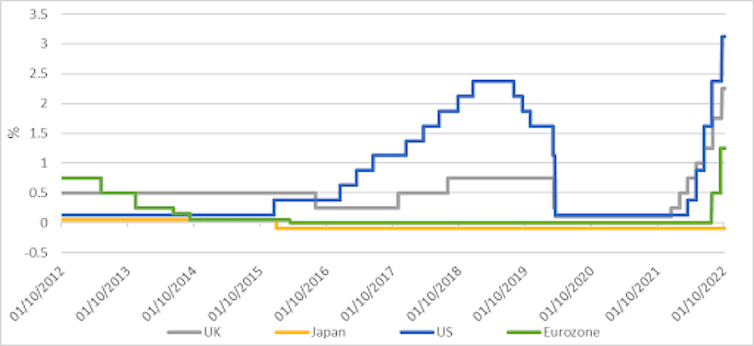

Latest fee alterations by central banks

Author’s chart using Financial institution for Intercontinental Settlements info.

These charge hikes and policy tightening approaches by central banking institutions could make significant economic and fiscal instability. Already, the US Federal Reserve’s unwinding of its stability sheet from a peak of US$8.97 trillion (£7.9 trillion) in April 2022, for example, brought on the dollar to respect by extra than 13% in the final 6 months. This has created worries for emerging market currencies, as properly as major currencies – the yen, pound sterling and the euro – which have all depreciated substantially in opposition to the US dollar.

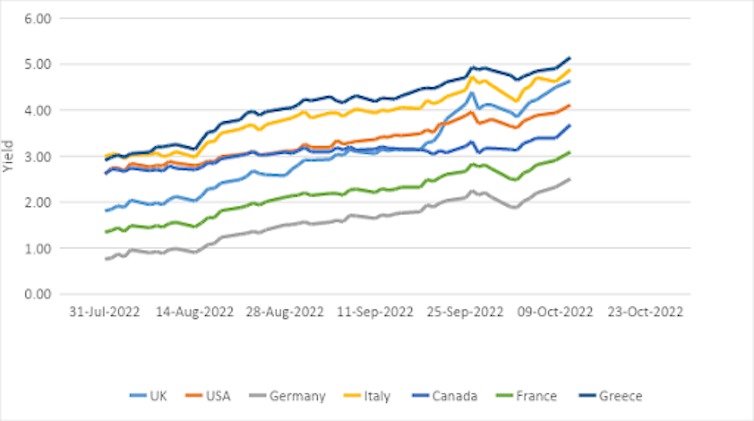

This has additional to inflationary pressures, specifically in the Eurozone and United kingdom, but it also impacts sovereign bond yields, hard economic steadiness in these nations. Considering the fact that August, the value of borrowing has far more than doubled for several.

The climbing cost of authorities borrowing

Author’s chart utilizing Thomson Reuters info.

But to address rising inflation, even additional central banking companies will want to shrink their harmony sheets by advertising bonds. The whole dimensions of the asset obtain programmes of the major four central banking institutions on your own is about US$26.7 trillion. With a weak global economic system and these other financial fragilities, this is likely to be a unpleasant exercising for the global overall economy.

In fact, such tightening will improve the cost of authorities borrowing further, developing important troubles, notably for highly leveraged governments, and those people nevertheless paying off pandemic-period assist this kind of as the United kingdom and Eurozone.

The British isles especially, is also dealing with a change in the global economic centre of gravity away from its economy. In a lot less than two a long time, the Uk has shrunk in relative conditions from becoming an economic climate larger sized than China to getting about 9 times more compact. And the pound no lengthier enjoys the same status as the US dollar, this means economic marketplaces will punish it severely if it actions out of line.

This indicates the new British isles govt faces a tough task in reigniting world-wide investor confidence in its economic security, even with a new prime minister extensively seen as a continual hand.![]()

Muhammad Ali Nasir, Associate Professor in Economics, University of Leeds

This article is republished from The Dialogue less than a Innovative Commons license. Read the unique post.