What Kind Of Shareholders Hold The Majority In BT Group plc’s (LON:BT.A) Shares?

If you want to know who really controls BT Group plc (LON:BT.A), then you will have to glimpse at the make-up of its share registry. Institutions often possess shares in much more established organizations, although it’s not strange to see insiders own a good bit of lesser providers. I pretty like to see at the very least a tiny bit of insider ownership. As Charlie Munger mentioned ‘Show me the incentive and I will present you the consequence.

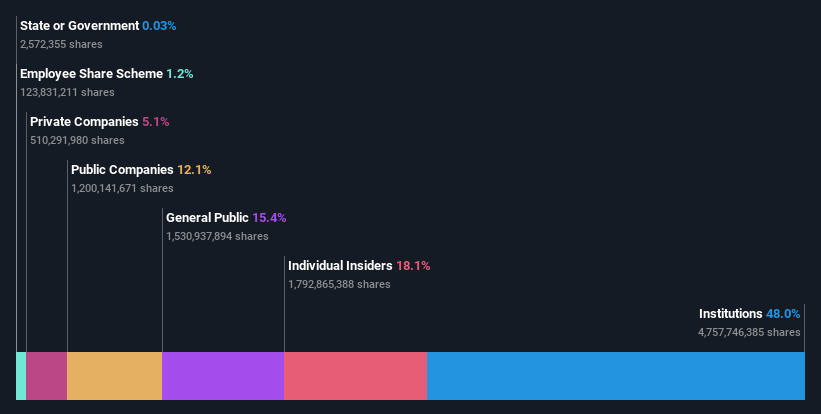

BT Group has a current market capitalization of UK£19b, so it is too massive to fly underneath the radar. We would count on to see both institutions and retail buyers possessing a portion of the business. Our analysis of the ownership of the enterprise, below, exhibits that institutional traders have purchased into the enterprise. Let us delve deeper into every single style of proprietor, to find out additional about BT Team.

Check out our newest evaluation for BT Group

What Does The Institutional Possession Inform Us About BT Group?

Establishments usually evaluate by themselves in opposition to a benchmark when reporting to their individual buyers, so they often develop into additional enthusiastic about a stock at the time it really is involved in a major index. We would assume most providers to have some establishments on the sign up, particularly if they are expanding.

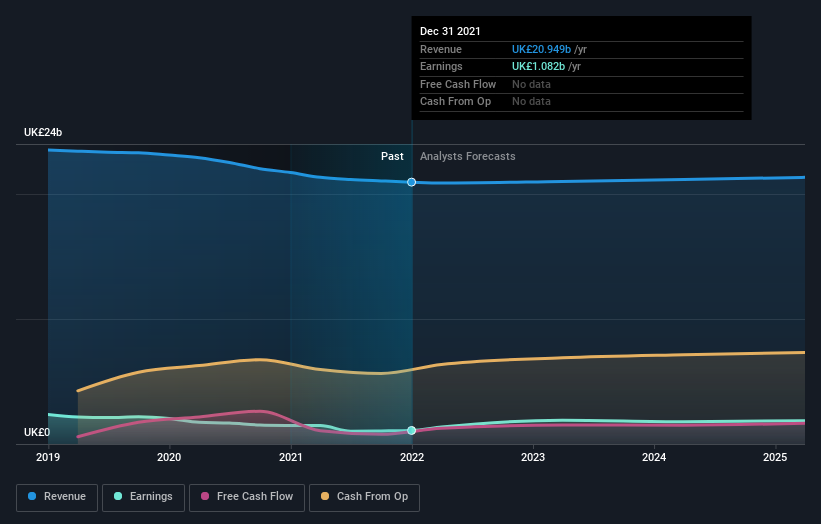

As you can see, institutional traders have a truthful amount of stake in BT Group. This implies some trustworthiness amongst experienced investors. But we won’t be able to count on that point on your own considering the fact that establishments make lousy investments in some cases, just like everybody does. If various institutions improve their watch on a stock at the identical time, you could see the share price tag fall rapid. It’s thus value seeking at BT Group’s earnings historical past under. Of class, the potential is what definitely issues.

We note that hedge funds will not have a meaningful investment in BT Group. Our information exhibits that Patrick Drahi is the premier shareholder with 18% of shares excellent. In comparison, the next and third most significant shareholders hold about 12% and 5.% of the stock.

On more inspection, we identified that extra than half the firm’s shares are owned by the major 8 shareholders, suggesting that the interests of the more substantial shareholders are balanced out to an extent by the smaller ones.

Whilst studying institutional ownership for a corporation can add price to your analysis, it is also a great apply to analysis analyst suggestions to get a deeper fully grasp of a stock’s expected general performance. There are a realistic amount of analysts masking the inventory, so it may possibly be practical to locate out their combination see on the upcoming.

Insider Possession Of BT Group

The definition of corporation insiders can be subjective and does fluctuate in between jurisdictions. Our details demonstrates individual insiders, capturing board users at the pretty the very least. Corporation management operate the company, but the CEO will respond to to the board, even if he or she is a member of it.

Insider ownership is constructive when it signals management are thinking like the true owners of the business. However, substantial insider ownership can also give huge energy to a tiny group within just the business. This can be damaging in some conditions.

Our most new info signifies that insiders individual a sensible proportion of BT Team plc. Insiders very own UK£3.4b really worth of shares in the UK£19b corporation. That’s rather meaningful. Most would be pleased to see the board is investing together with them. You may well desire to access this absolutely free chart displaying current trading by insiders.

Basic Community Possession

The normal general public, who are ordinarily unique traders, maintain a 15% stake in BT Team. Whilst this dimension of possession may not be plenty of to sway a plan determination in their favour, they can even now make a collective impression on firm guidelines.

Personal Enterprise Ownership

We can see that Non-public Companies own 5.1%, of the shares on challenge. It’s tricky to draw any conclusions from this simple fact on your own, so its worthy of on the lookout into who owns all those personal corporations. At times insiders or other connected parties have an fascination in shares in a public business by a individual personal organization.

Community Business Possession

We can see that public corporations hold 12% of the BT Team shares on issue. We can not be sure but it is really attainable this is a strategic stake. The businesses may perhaps be comparable, or perform with each other.

Upcoming Actions:

Whilst it is properly value thinking about the different teams that very own a business, there are other aspects that are even a lot more significant. Case in position: We have spotted 3 warning indications for BT Group you must be mindful of.

If you are like me, you may possibly want to assume about regardless of whether this organization will mature or shrink. Luckily for us, you can test this cost-free report exhibiting analyst forecasts for its long run.

NB: Figures in this article are calculated applying knowledge from the very last twelve months, which refer to the 12-thirty day period period of time ending on the final day of the thirty day period the financial assertion is dated. This might not be dependable with entire calendar year annual report figures.

Have suggestions on this write-up? Involved about the written content? Get in contact with us instantly. Alternatively, electronic mail editorial-group (at) simplywallst.com.

This report by Only Wall St is typical in nature. We give commentary centered on historic knowledge and analyst forecasts only working with an impartial methodology and our articles are not intended to be fiscal assistance. It does not constitute a suggestion to purchase or promote any inventory, and does not just take account of your targets, or your monetary situation. We goal to provide you long-time period targeted examination driven by fundamental data. Take note that our investigation might not element in the hottest rate-delicate enterprise bulletins or qualitative content. Simply just Wall St has no position in any stocks mentioned.