When compared with credit score cards, particular financial loans provide reduce fascination fees and a lot more favorable repayment terms. (iStock)

Credit history card paying can be an highly-priced way to cover the expense of unanticipated costs, like auto repairs and shock medical costs, due to significant curiosity charges. Shoppers are likely to shell out some of the highest fascination rates on revolving credit score card credit card debt which is carried over from month to month.

Of issue, Us residents are getting significantly reliant on credit rating card credit card debt in 2021 as revolving credit history balances skyrocketed to pre-pandemic levels. But thankfully, it may be feasible to fork out off credit history card debt speedier working with a personal bank loan — all whilst saving hundreds of bucks in desire charges in excess of time.

Preserve reading to find out far more about the gains of consolidating credit score card financial debt into a personalized personal loan, and stop by Credible to evaluate personal debt consolidation loan prices for no cost without the need of impacting your credit score rating.

Regular Family PAYS $1K IN Credit rating CARD Fascination AND Charges Per year

Credit history card consolidation can preserve some debtors $4K

Creating the least payment on your credit history cards can be an expensive way to repay high-curiosity financial debt. The common credit history card desire amount is at 16.44%, in accordance to the Federal Reserve, which is much greater than premiums for other economical products like automobile financial loans and home loans.

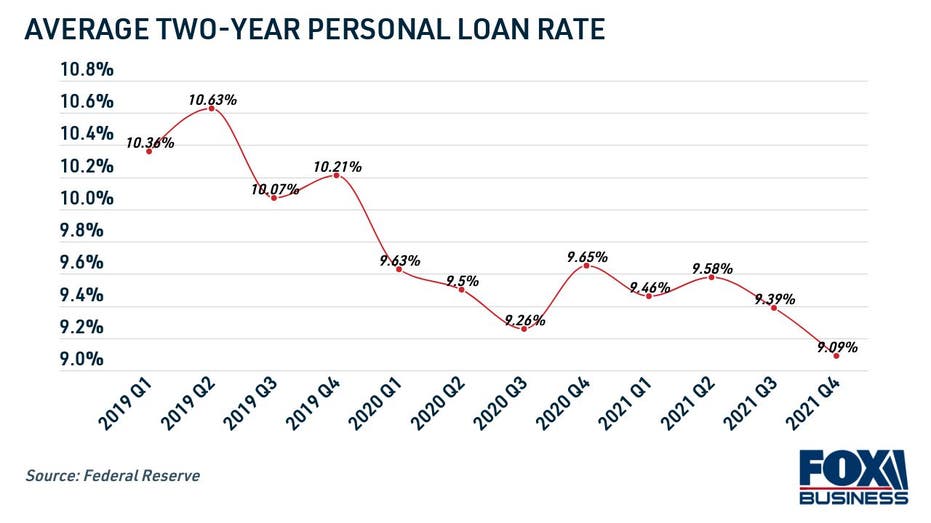

Consolidating credit history card debt into a particular personal loan is just one way to pay back off financial debt faster and conserve cash though carrying out so. That’s due to the fact ordinary individual mortgage prices are now at document lows, Fed data demonstrates — just 9.09% for the two-calendar year financial loan expression.

Credit card debt SNOWBALL Approach VS. Financial debt AVALANCHE

A credit card user who will make the minimum payment on $10,000 value of credit card personal debt at a 16.44% rate will pay $5,000 in curiosity prices. It will acquire virtually 14 a long time of $400 every month payments to get out of debt using this technique.

This borrower has the prospective to conserve 1000’s of pounds and pay out off their financial debt 12 years a lot quicker by consolidating into a individual mortgage. Repaying $10,000 worthy of of credit card personal debt with a two-yr particular mortgage at a 9.09% price will help save them much more than $4,000 about time, even though including just $50 to their month to month payment.

To identify your probable personal savings, use a credit card minimum amount payment calculator. Then, use Credible’s particular bank loan payment calculator to establish your new every month payments and general curiosity costs.

Private Financial loan ORIGINATION Charges: ARE THEY Worthy of THE Expense?

How to shell out off credit rating playing cards with a own mortgage

It is fairly straightforward to consolidate credit history card financial debt into a own mortgage. The software system can be accomplished totally on the web, so you can get started preserving funds without having leaving the comfort of your home. This is what you can expect to need to do:

- Decide how considerably you need to borrow. You can consolidate the balances of just one or more credit rating cards into a private financial loan, so incorporate up the complete personal debt across all the accounts you want to repay.

- Test your credit score. Borrowers with really fantastic to superb credit history scores, defined by the FICO product as 740 or earlier mentioned, will get the cheapest costs feasible on a particular personal loan.

- Review own bank loan prices. Most creditors allow you get prequalified to see your estimated terms with a tender credit history check, which won’t influence your credit score.

- Formally implement for the mortgage. This will demand a hard credit inquiry, which will exhibit up on your credit report with a nominal impression to your rating.

- Pay back off your credit rating playing cards. Personalized financial loan funding is quickly, typically obtainable on the subsequent organization day after financial loan approval. Use your financial loan resources to pay out off your credit score card balances to zero.

If you determine to consolidate credit history card credit card debt with a own personal loan, it’s important to spend wisely to keep away from racking up a lot more credit history card personal debt whilst you repay your present-day financial debt.

You can look through present particular bank loan interest fees in the desk under, and visit Credible to examine charges throughout various loan companies at at the time without impacting your credit score score. Purchasing all around ensures that you are going to come across the least expensive charge possible for your financial problem.

HOW TO GET A Stability TRANSFER Credit rating CARD

Have a finance-related query, but you should not know who to ask? E-mail The Credible Funds Pro at [email protected] and your issue could be answered by Credible in our Revenue Expert column.