UK labour market remains hot despite stalling economy

Stalling economic progress has not nevertheless taken the warmth out of the United kingdom labour market place, in accordance to formal facts on Tuesday that confirmed the variety of total-time employees at an all-time large, although the selection of vacancies rose to a report 1.3mn.

On the other hand, the details contained some early signs that the careers sector could be on the switch, with hiring slowing and unemployment edging up.

Economists reported that while the figures supported the case for the Financial institution of England to elevate interest fees yet again at its conference on Thursday, they could lessen the argument for a big enhance or for continued aggressive policy tightening.

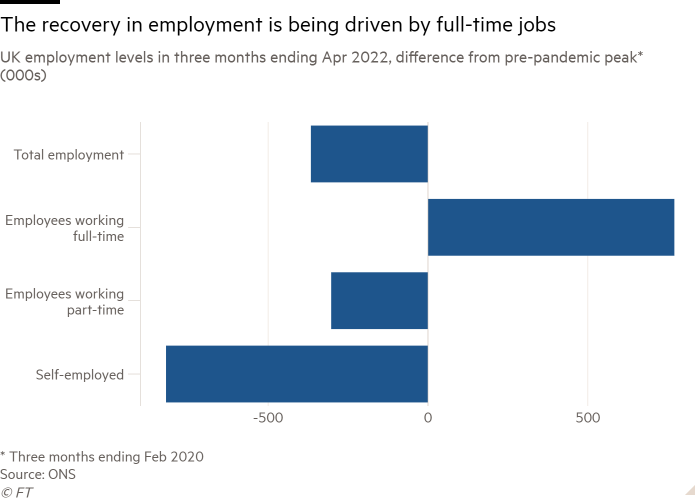

The figures, released by the Business for Countrywide Figures, showed the employment charge rose to 75.6 for every cent in the a few months to April, up .2 share details on the quarter and a larger rise than economists had predicted. This was driven by full-time employment, with portion-time perform and self-employment even now under pre-pandemic degrees.

Sandra Horsfield, economist at Investec, said “solid labour demand . . . in the context of purple-hot shopper selling price inflation” would validate the circumstance for further more monetary plan tightening, whilst Hugh Gimber, strategist at JPMorgan Asset Management, stated the facts confirmed the “conundrum” going through the BoE, as “central banks are remaining pressured to tighten at a time when there are currently obvious signals that development is slowing”.

Nonetheless, the information confirmed that the breakneck pace of using the services of in the latest months has slowed. Vacancies, whilst at a document, had been only slightly higher than the past month. Unemployment rose in April, getting the jobless price above the a few months to 3.8 for every cent — slightly over the 50-12 months low recorded a month previously.

“The labour marketplace could now be at a turning issue,” claimed Greg Thwaites, investigate director at the Resolution Basis think-tank, though James Smith, economist at investment decision financial institution ING, claimed: “We can tentatively say that employee shortages are no for a longer time actively obtaining worse.”

This is partly mainly because at minimum some of the persons who have still left the workforce because the start off of the pandemic are now starting to return. The ONS claimed financial inactivity fell by .1 proportion details in the 3 months to April, as young persons who had stayed in complete-time education and learning instead than get started their occupations mid-pandemic came back again.

Kitty Ussher, main economist at the Institute of Directors, reported this was “encouraging for companies that were being having difficulties to fill vacancies”, as it need to make long run position openings a lot easier to fill and decrease inflationary force. She added that there ended up also “early symptoms that the labour current market is commencing to settle”, with the price of hiring slowing and a tiny increase in limited-term unemployment.

Chancellor Rishi Sunak stated the figures confirmed the employment market place remained strong, incorporating that supporting persons into better jobs was the best way to support them in the long expression, despite the fact that the federal government was also giving “immediate assist with climbing prices”.

However, inflation is now starting up to hit fork out packets difficult. Whilst pay progress is still potent by historical standards, common weekly earnings were being 3.4 per cent reduce in authentic conditions than a yr earlier in April, the month when the cap on residence power charges changed.

Even immediately after including bonuses, the single month info for April showed whole spend experienced fallen sharply in real conditions, though it had broadly saved pace with inflation around the a few-thirty day period period of time.

The data will enhance the case for the Financial Policy Committee to elevate fascination prices again when it fulfills this 7 days. The BoE created it crystal clear in its May well forecasts it considered nominal wage growth was operating at an unsustainable rate and unemployment would need to have to rise if inflation was to return to its 2 for every cent goal in the medium phrase.

Paul Dales, at the consultancy Funds Economics, stated nominal wage growth remained unusually robust, but evidence of a “slightly looser labour market” might tilt the MPC in direction of increasing interest costs by 25 foundation factors instead than 50 basis points.

On the other hand, Samuel Tombs, at the consultancy Pantheon Macroeconomics, reported it was encouraging that wage advancement had steadied and workforce quantities had begun to recuperate. “The labour sector stays very tight, but it is not supporting domestically-produced inflation enough to provoke the MPC into a collection of rapid price hikes that would press the economy into a economic downturn,” he said.